Private mortgage brokers compared to. banks-what is the variation? Whilst it may appear instance a trivial choice, who you choose financing their a property purchase tends to make a large impact on the sense.

It’s a giant monetary decision buy you want and come up with confidently. Probably one of the most very important elements of to purchase a home are the method that you financing the acquisition.

If you don’t have half a million cash liquidated, attempt to sign up for a loan to cover the will set you back of the house. That’s why you should know the difference between personal loan providers and you may antique banks.

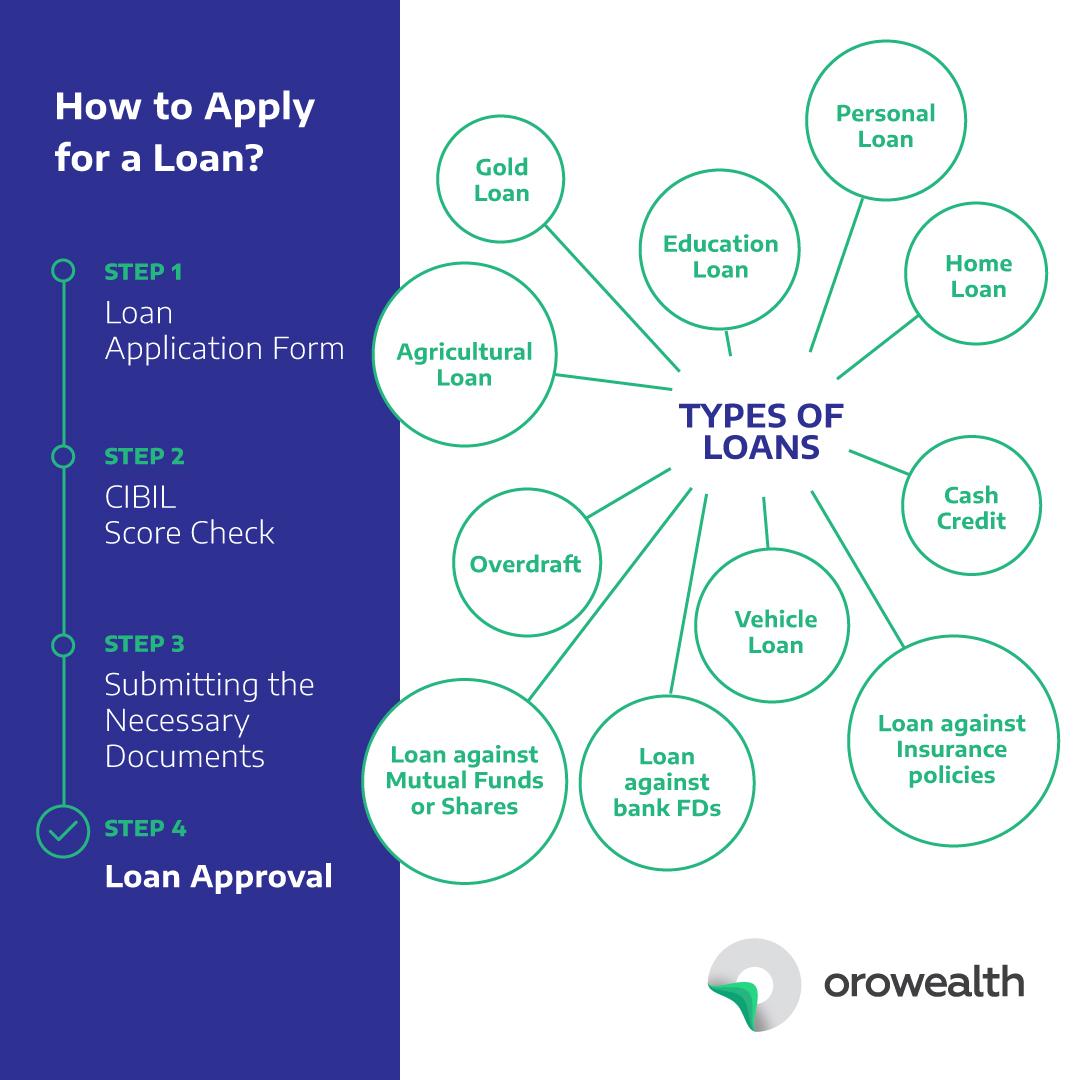

You’ll find different types of finance and you may loan providers you are able to to do so. We want one end up being positive about your financial decision. That is why we describe the difference between working with individual lenders vs antique loans.

What is a private Lender?

Individual loan providers are some body or several individuals who financing money so you’re able to a borrower without having to be supported by a lender otherwise borrowing from the bank union. Private lenders might be businesses otherwise a member of family.

Individual lenders are a great option for each other a house and you can unsecured loans. Private lenders is actually a little more accommodating because they do not possess so you can succumb into foibles of a bank.

Although individual lenders and you can antique financial institutions possess its differences, the procedure of acquiring that loan is similar. You have made acknowledged to find a home, make purchase, and you may reduced repay the debt loans Silver Plume during the period of the fresh mortgage.

Individual lenders have a tendency to bring choice resource options for various intentions, plus real estate opportunities, businesses, signature loans, and a lot more. These firms shall be anyone trying invest her investment otherwise certified lending companies that work on certain version of funds.

Commons Functions off Individual Loan providers

- Non-Institutional Resource: Individual loan providers are not traditional finance companies otherwise loan providers. Alternatively, they services alone or as part of private lending enterprises.

- Flexible Words: Private lenders often promote even more self-reliance with regards to loan structures, cost times, and you can qualification conditions versus traditional loan providers. This independence might be specifically useful for consumers with exclusive economic factors otherwise capital measures.

- Asset-Built Lending: Personal financing can be asset-built, definition the loan are protected from the a valuable asset, such as for instance a residential property, one to serves as equity. This permits individual loan providers to decrease risk by having a real house to recoup in case the debtor defaults.

- Speed and you may Abilities: Private lenders could possibly offer smaller approval and you may financing procedure compared to the antique lenders. Which rates are going to be crucial for individuals who need fast access in order to financing.

- Varied Loan Versions: Personal lenders offer all types of loans, such as for example difficult money finance, link financing, short-title loans, and private finance. For each and every loan type provides certain debtor need and you will money wants.

- Shorter Stringent Borrowing from the bank Standards: Personal lenders may focus quicker into fico scores and more into the the value of the fresh new collateral and/or potential of financial support.

What exactly is a timeless Bank?

A classic bank loan try that loan that you will get away from a financial or borrowing commitment. In advance of there are private loan providers and you can dealers, the lending company try the sole place to score an interest rate. Which as to the reasons its called the traditional means.

Financial institutions make use of the currency they get out of depositors to get mortgages. Then they return off of the interest of your own real estate loan as household might have been purchased. As banking companies try a financial firm there are many laws and you may statutes that they have to realize compared to the private lenders.

Private Mortgage lenders vs. Financial institutions?

For starters, finance companies are much more strict than just private lenders. Private loan providers be able to become more flexible to help you their customers, carrying out flexible agreements that help them arrive at the a property requires. Finance companies has rigid requirements that every prospective homeowner must fulfill to become acknowledged.