Even in the event the goes better on the mortgage as well as the debtor produces their repayments per month, getting a co-signer can invariably feeling your next loan approval opportunity.

Any loans you’ve co-signed can be used in the DTI, if in case the DTI is actually large, financial institutions you certainly will won’t provide for your requirements.

Factors ahead of co-finalizing

Co-finalizing home financing might be a terrific way to assist a good friend, but it’s together with a huge choice that can impression the two of you economically and legitimately. Be sure to need these types of issues into consideration ahead of co-finalizing that loan.

Monetary fuel of one’s number one debtor

As becoming an excellent co-signer is really risky, you should features an open talk to your borrower on its funds and money.

The same as exactly how loan providers see applicants’ payment records to understand how they usually have treated personal debt previously, you can also would like to get a world confirmation away from the debtor you’re co-finalizing regarding he has got an excellent reputation for into the-day money, which these are generally during the an excellent location to build future mortgage money.

For example making sure they aren’t borrowing more than they may be able manage. Your mutual earnings will help them be eligible for a larger loan, nonetheless cannot undertake a top monthly payment than they may be able easily pay for.

Their monetary protection

/GettyImages-185278966-598dc7306f53ba001024de44.jpg)

You should think of their profit, as well. Are you experiencing the money available to improve borrower’s mortgage repayments when they can’t? Are you experiencing deals available, otherwise? What might end up being your copy bundle if you have to take more than payments?

When you have contradictory money otherwise try short towards discounts, taking on most obligations – even when there is certainly simply a little opportunity you will have to generate payments inside it – are a huge exposure.

Relationship with the fresh borrower

The reference to this new borrower must be the cause. How good have you any idea and you will trust them? Tend to they make a great concerted efforts and make the repayments and you can protect its credit? You may also should contemplate how the dating can get become inspired if the things go south.

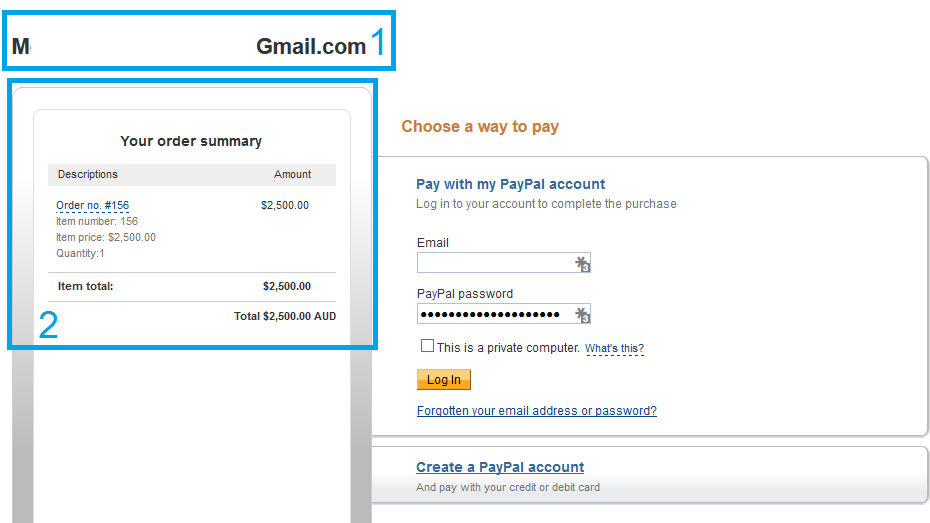

A fast suggestion: You are capable prevent a number of the risk to help you your credit (along with your dating) by the asking the brand new borrower in order to entry to financing information, potentially compliment of an internet commission webpage, so you’re able to be sure the latest debtor is often and also make costs.

The process based on how locate of home financing as the a beneficial co-signer may differ, however, normally, the fresh debtor will have to re-finance. For those who no more wish to be an effective co-signer, this new debtor will need to be inside an excellent adequate set financially in which capable re-finance into a mortgage it qualify for by themselves.

What takes place for those who co-signal a home loan plus they cannot shell out is a type of concern. When your number 1 debtor closes and come up with costs, the new co-signer are legitimately guilty of and make the individuals costs rather. When they you should never, the financial institution you will foreclose for the family, impacting the financing out-of both the borrower and co-signer. This may and additionally cause range attempts.

There are various solutions so you’re able to co-finalizing a mortgage. You could allow the borrower a down-payment current instead, which may improve their mortgage-to-worth ratio while making it easier to meet the requirements. You might also getting an excellent co-borrower on mortgage, providing you with a share about assets, or even the borrower you will enhance their credit score otherwise obligations-to-money ratio before you apply towards the financing.

Believe piecing together an agreement anywhere between both you and brand new co-borrower describing your own installment online installment loans Maryland with no credit check direct lenders traditional. You can even inquire about entry to the loan percentage portal to be sure the borrower is to make costs promptly.